Xbox remains a central force in the global gaming landscape, balancing traditional console sales with digital services like Xbox Game Pass and cloud gaming. The brand’s performance affects hardware makers, subscription services, and game developers alike, shaping how millions of users play. In real-world terms, Game Pass has become a subscription anchor for many families and professionals who balance gaming with work-from-home lifestyles, and cloud streaming is expanding access to high-end titles on phones and low-end PCs. Explore below for the latest Xbox statistics shaping the gaming industry this year.

Editor’s Choice

- Xbox Game Pass reached 37 million subscribers by Q1 2025, reflecting ongoing demand for subscription gaming.

- Xbox Series X|S lifetime global unit sales now exceed 33 million+ since launch.

- Xbox Live monthly active users are 130 million as of 2025, up from 120 million in 2024.

- Xbox content and services revenue grew 13% year-over-year in recent reporting.

- Cloud gaming usage on Game Pass climbed 45% YoY as of late 2025.

- Game Pass nearly generated $5 billion in annual revenue for Xbox.

- Price hikes on Game Pass Ultimate increased subscription costs by 50%.

Recent Developments

- Microsoft announced a 50% price increase for Xbox Game Pass Ultimate in October 2025, raising it to $29.99 per month.

- Xbox Game Pass added 48 new titles alongside pricing changes, reinforcing library depth.

- Cloud gaming hours increased 45% YoY, signaling strong streaming adoption.

- Expansion of Xbox Cloud Gaming to 29+ countries continues to broaden reach.

- Call of Duty became the most-played franchise on Xbox Game Pass during 2025.

- Microsoft reported 500 million monthly active users across its gaming platforms, including Xbox and associated titles.

- Xbox content and services growth continues to outpace hardware revenue growth.

- Cloud gaming expansion in Latin America drove significant subscription growth in select markets.

Console Sales and Market Share in the Xbox Ecosystem

- Xbox Series X|S has sold more than 33 million units globally since their November 2020 launch.

- Analyst estimates suggest Xbox’s console user base may level off at 42 million users by the end of 2025.

- Compared to PlayStation 5, Xbox hardware sales trail, with PS5 outselling Xbox by roughly 2.5 to 1 globally.

- Console sales softened in mid-2025, with Xbox hardware down 30% year over year in certain months.

- Price increases on Xbox Series X and Series S hardware correlated with slower sales growth.

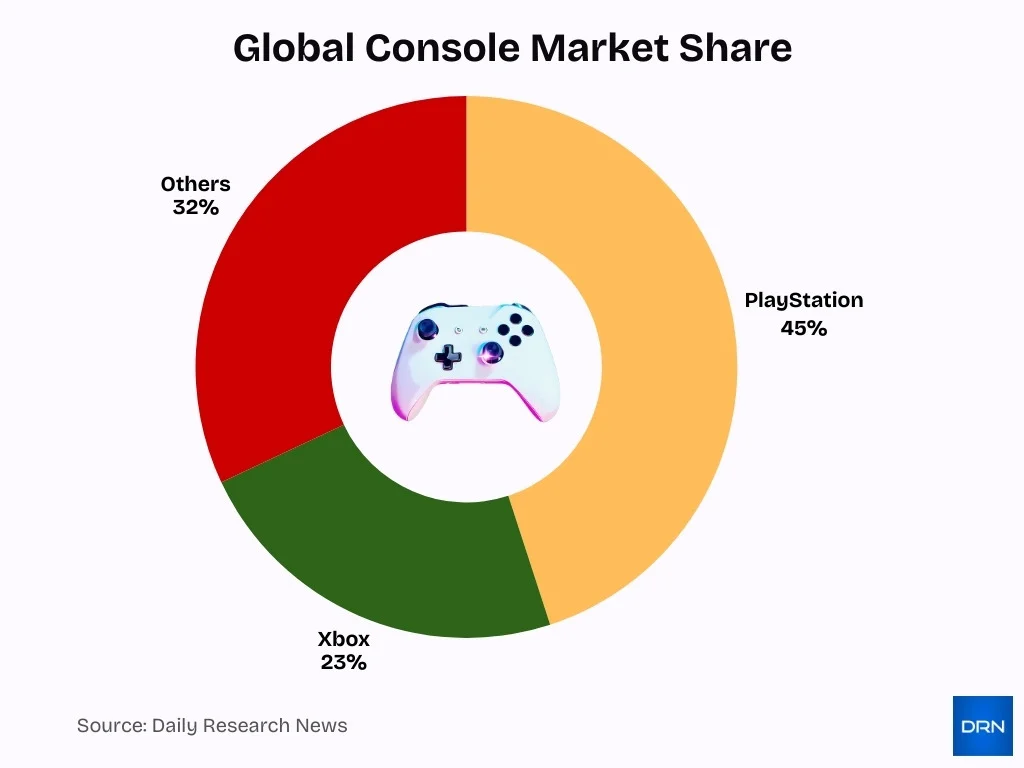

- Xbox holds approximately 23% of the global console market share, behind PlayStation and Nintendo.

- Competitive dynamics show Nintendo and Sony maintaining larger installed bases than Xbox.

- Xbox’s strategy increasingly emphasizes ecosystem reach over pure console volume.

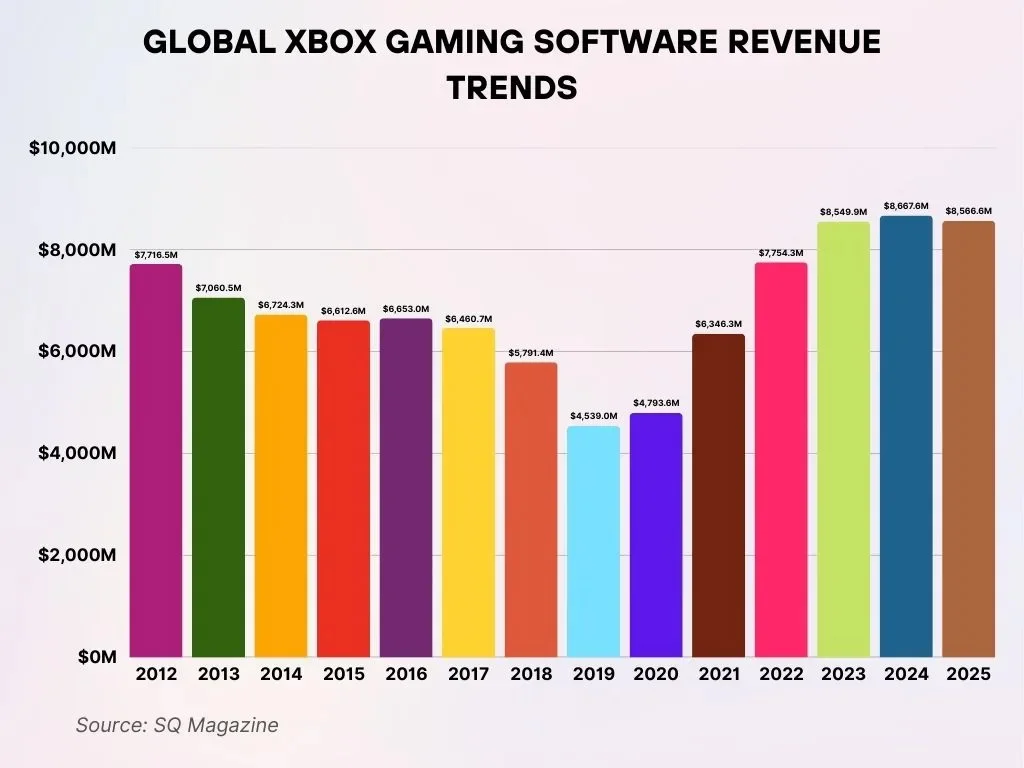

Worldwide Xbox Gaming Software Revenue Performance Trends

- In 2012, Xbox gaming software revenue climbed to $7.72 billion, representing one of the strongest early performance years for the platform.

- In 2013, revenue experienced a slight decline to $7.06 billion, extending a downward trajectory that persisted over subsequent years.

- From 2014 to 2016, revenue levels remained relatively stable at approximately $6.6 billion, reflecting consistent but modest decreases.

- In 2017, revenue dropped further to $6.46 billion, followed by a decline to $5.79 billion in 2018, signaling a weakening market environment.

- A significant downturn occurred in 2019, when revenue fell to $4.54 billion, marking the lowest point shown in the data.

- A minor recovery was observed in 2020 with $4.79 billion, followed by a stronger rebound in 2021, when revenue rose to $6.35 billion.

- In 2022, Xbox software revenue surged to $7.75 billion, and is projected to reach an all-time high of $8.67 billion in 2024.

- Revenue forecasts for 2023 and 2025 estimate $8.55 billion and $8.57 billion, respectively, indicating steady post-recovery growth following 2021.

Game Pass Subscribers and Revenue on Xbox Platforms

- Xbox Game Pass maintains 35 to 37 million subscribers in 2025.

- Subscriber growth has slowed compared with early expansion years but remains steady.

- The Ultimate tier accounts for 68% of total Game Pass subscribers.

- Subscriber counts rose from 34 million in early 2024 to 37 million by 2025.

- Game Pass contributes a substantial share of recurring annual revenue.

- Pricing adjustments aim to offset slower user growth while improving margins.

- Game Pass boosts retention across Xbox consoles and PC platforms.

- Cloud streaming within Game Pass drove 45% YoY growth in play hours.

User Base Statistics Across the Xbox Network

- Xbox Live supports approximately 130 million monthly active users in 2025.

- This reflects growth from roughly 120 million users in 2024.

- Microsoft’s broader gaming ecosystem includes 500 million monthly active users across platforms.

- Major franchises like Call of Duty drive spikes in network engagement.

- Xbox users access content via console, Windows PC, cloud, and mobile devices.

- Cloud gaming expands access for players without dedicated hardware.

- Engagement spans a wide demographic range across age groups.

- Network metrics include both paid and free Xbox Live accounts.

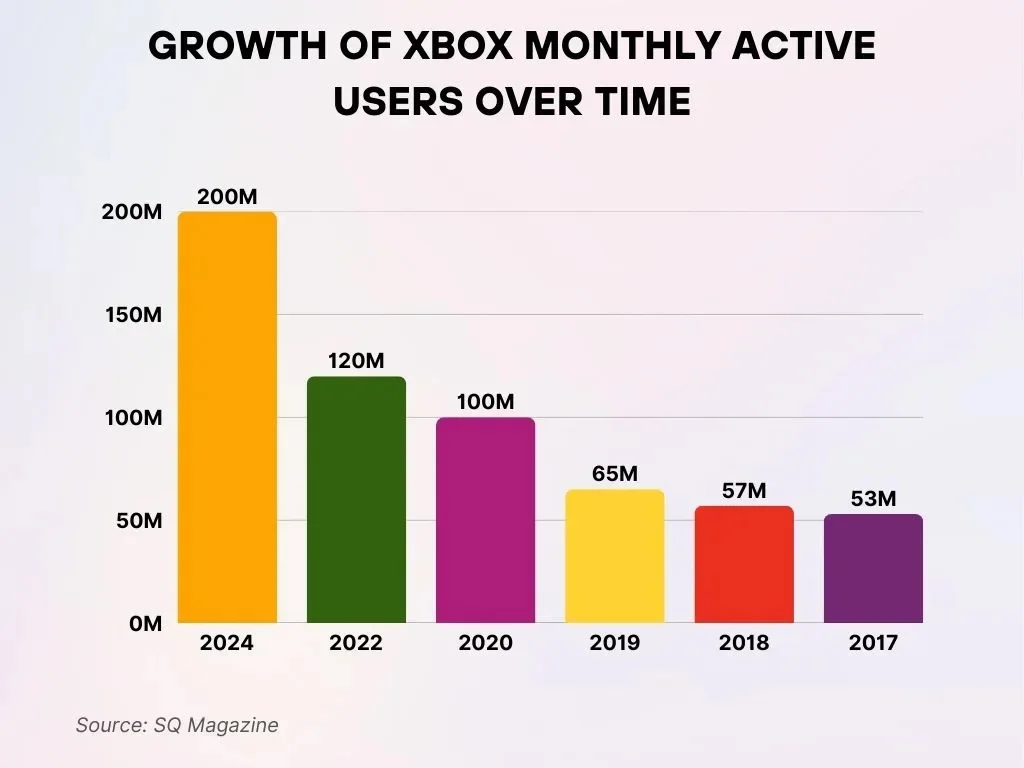

Growth of Xbox Monthly Active Users Over Time

- In 2024, Xbox achieved an all-time high of 200 million monthly active users, clearly demonstrating remarkable platform expansion and sustained user engagement.

- The year 2022 experienced a major surge, reaching 120 million users, representing a sharp rise compared to earlier periods.

- In 2020, the Xbox platform surpassed the 100 million user milestone for the first time, highlighting a critical growth phase.

- During 2019, Xbox recorded 65 million active users, reflecting a notable jump from previous user counts.

- The upward momentum continued from 57 million users in 2018 and 53 million in 2017, confirming a consistent and steady growth trend.

Series X|S Adoption Rates Among Xbox Players

- Xbox Series X|S sold over 1.28 million units during 2025.

- Lifetime Series X|S sales continue to rise gradually.

- Xbox Series X represents 62% of current-generation sales, with Series S at 38%.

- Digital-only consoles accounted for 75% of Xbox hardware sales in 2025.

- Adoption growth slowed compared with early launch years.

- Price sensitivity affected adoption rates in some regions.

- Xbox hardware adoption trails competing consoles globally.

- Many users access Xbox content without owning a Series console.

Generational Trends Across Xbox Console History

- Xbox 360 sold 84–86 million units, outpacing all other Xbox consoles.

- The original Xbox reached 24 million units worldwide, with 16 million in North America.

- Xbox One lifetime sales hit nearly 58 million units, exceeding 33 million in North America.

- Xbox Series X|S sold 33.68 million units by September 2025, trailing Xbox One by 8.87 million.

- The US claimed 42.7 million Xbox 360 units, representing 41% of total Xbox sales regionally.

- Xbox digital sales surged to 91% of total on Series X|S, shifting from physical dominance.

- Over 50% of Xbox One users played Xbox 360 backward-compatible titles.

- Xbox Live connected over 50% of Xbox 360 consoles, up from 10% on the original Xbox.

- Series S comprises 38–45% of current-gen Xbox sales, boosting affordable adoption.

- Xbox monthly active users hit 200 million in 2024, emphasizing service-driven growth.

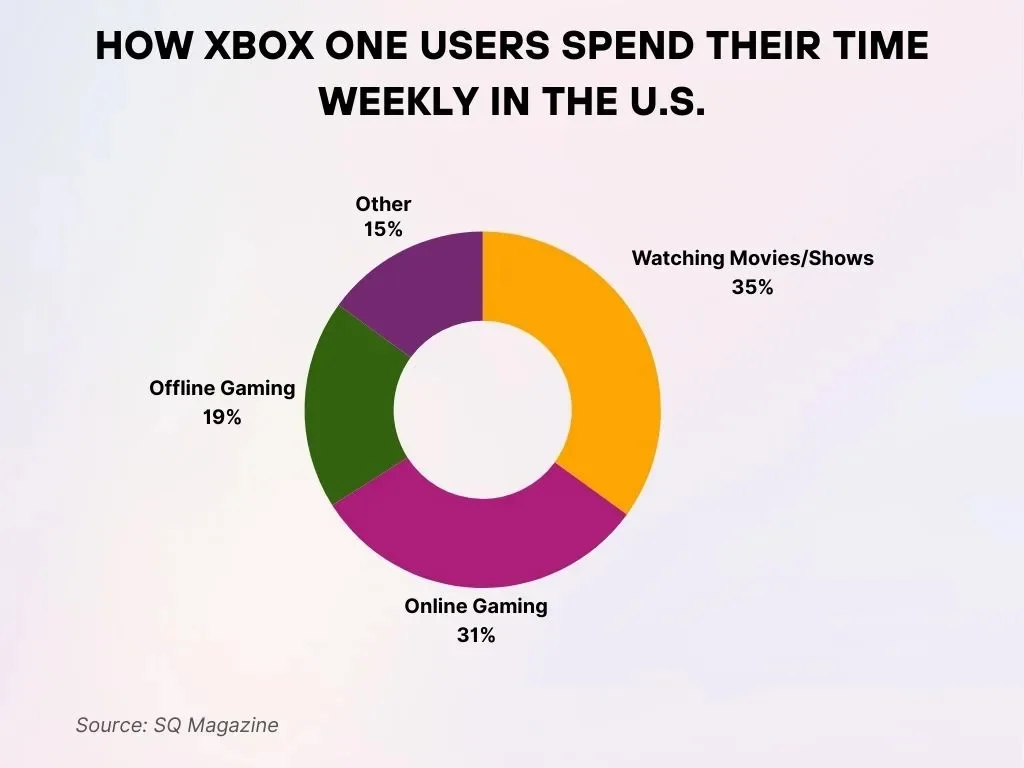

Weekly Time Allocation of Xbox One Users in the U.S.

- Watching Movies and TV Shows ranks as the leading activity, accounting for 35% of total weekly console usage, clearly emphasizing Xbox One’s position as a comprehensive entertainment hub for users.

- Online Gaming represents 31% of weekly usage, demonstrating strong engagement in multiplayer experiences and internet-connected gameplay among Xbox One players.

- Offline Gaming comprises 19% of overall usage, reflecting that a significant segment of users continues to prefer single-player or non-connected gaming experiences.

- Other Activities, including apps and browsing, make up 15% of total usage, highlighting Xbox One’s broader functionality and versatility beyond traditional gaming.

Player Engagement and Playtime Within Xbox Titles

- Call of Duty ranked #1 on Xbox Game Pass for total players and hours played throughout 2025.

- Cross-platform titles show 25–45% higher retention than single-platform games on Xbox.

- Xbox cloud gaming accounts for at least 10% of total Xbox play hours across devices.

- Game Pass users play an average of 18 titles per year, up from 15 in 2023.

- Series X|S reduces load times by up to 75%, enabling longer play sessions.

- Game Pass Ultimate subscribers comprise 68% of total subs with 34% higher engagement hours.

- Black Ops 6 launch spiked average Xbox playtime by 20% to 10.4 hours in November.

- Game Pass cloud hours surged 45% year-over-year in 2025.

Regional Market Performance for Xbox Consoles

- North America holds Xbox’s strongest performance with 32% console market share in 2024.

- Xbox consoles sold in Latin America surged by 22% in 2024, led by Brazil and Mexico.

- Japan Xbox Series X|S sales reached approximately 600,000 units as of mid-2024.

- Europe shows Xbox Series X|S at 0.46 million units YTD through October 2025, down YoY.

- Xbox Cloud Gaming streaming hours grew 45% YoY, expanding to 29 countries, including emerging markets.

- Regional pricing nearly doubled Xbox Game Pass Ultimate to 120 BRL (~$22) in Brazil.

- North American Xbox users drive 41% of all global Xbox console sales from the US.

- Xbox hardware sales revenue hit $5.2 billion in 2024, up 15% YoY amid infrastructure growth.

Digital vs Physical Game Sales on Xbox Systems

- Digital game sales represent 81% of Xbox Series X|S software revenue.

- Physical disc sales dropped to 19% of Xbox Series game sales in Europe during 2024.

- Xbox content and services revenue, primarily digital, grew to $12.9 billion in 2024.

- Digital-only Xbox consoles accounted for 75% of Series X|S sales in 2025 YTD.

- Xbox software revenue hit a peak of $8.67 billion in 2024, driven by digital channels.

- Game Pass titles lose up to 80% of expected premium digital sales on Xbox.

- The overall gaming industry saw 95% digital game sales versus 5% physical in 2025.

- Xbox digital services achieved a 49.8% gross margin compared to hardware’s 21.5%.

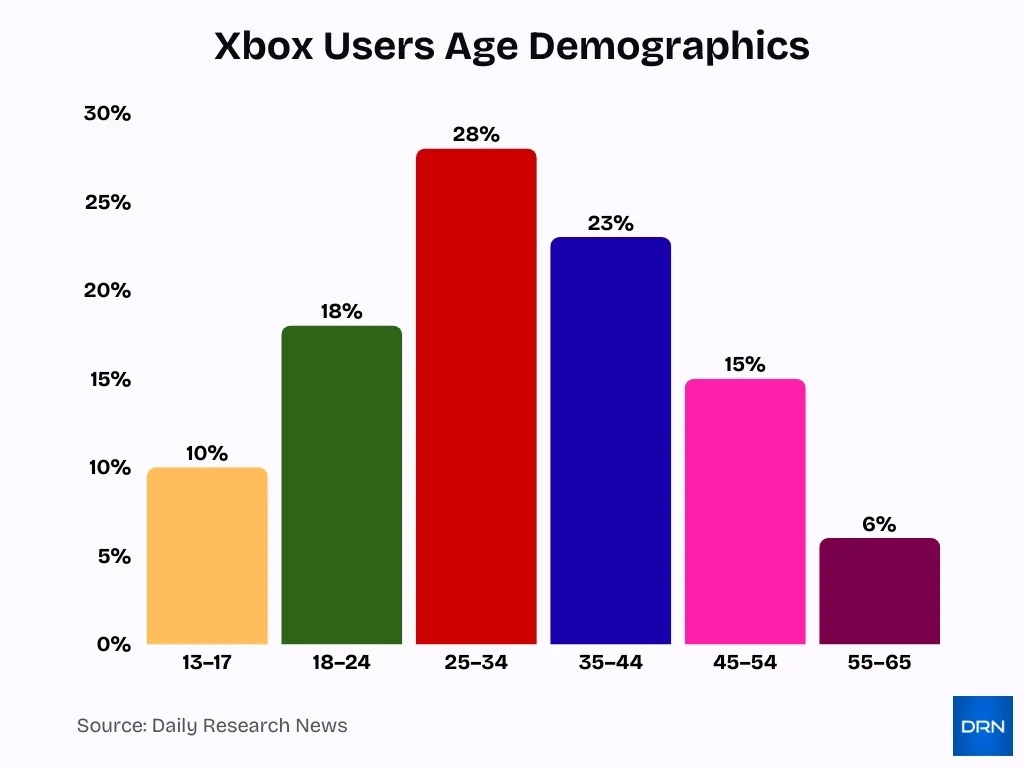

Xbox Users Age Demographics

- The largest share of Xbox users (28%) falls within the 25–34 age group, highlighting strong engagement among young adults.

- Gamers aged 35–44 represent the second-largest segment at 23%, showing that Xbox maintains solid appeal beyond younger audiences.

- The 18–24 age group accounts for 18% of users, reflecting continued popularity among college-age and early-career gamers.

- Users aged 45–54 make up 15%, indicating a notable presence of mid-age gamers in the Xbox ecosystem.

- Teen gamers aged 13–17 contribute 10%, suggesting Xbox has a smaller but still meaningful foothold among younger players.

- The 55–65 age group represents the smallest share at 6%, showing limited but existing adoption among older users.

- Overall, more than half of Xbox users (51%) are between 25 and 44 years old, underscoring Xbox’s strongest engagement with working-age adults.

Cloud Gaming and xCloud Usage Among Xbox Users

- Xbox cloud gaming hours among Game Pass members surged 45% year-over-year in 2025.

- Service expanded Xbox Cloud Gaming availability to 29 countries, including India, Argentina, and Brazil.

- Console users increased cloud streaming time by 45% while other devices saw 24% more usage.

- Xbox Game Pass reached 37 million subscribers by Q1 2025, with 68% on the Ultimate tier.

- xCloud users streamed over 1.2 billion hours in 2024, doubling from the previous year.

- Gaming subscription services like Xbox Game Pass achieved an average of 81% retention rates in 2025.

- The global cloud gaming market is valued at $9.32 billion in 2025, growing at a 50% CAGR.

- Cross-platform gamers represent 72% of global players, strongest in cloud services.

- Xbox Cloud Gaming accounts for at least 10% of total Xbox game hours across devices.

Cross-Platform and PC Integration in the Xbox Ecosystem

- Xbox Play Anywhere boosts player activity by 20% compared to non-supported titles.

- Over 1,100 games support Xbox Play Anywhere for seamless cross-device progress syncing.

- Xbox Cloud Gaming accounts for at least 10% of total Xbox game hours across devices.

- Game Pass cloud gaming hours surged 45% year-over-year among subscribers.

- 61% of U.S. gamers play across multiple platforms, including Xbox and PC.

- Xbox Game Pass reached 37 million subscribers by Q1 2025 with cross-platform access.

- 72% of global gamers engage on two or more platforms via Xbox ecosystem features.

- Cross-platform titles improve game retention by 25-45% through multi-device continuity.

Top Game Franchises Driving Xbox Engagement

- Call of Duty topped Xbox Game Pass for total players and hours in 2025.

- Forza Horizon 5 reached 50 million players worldwide as of August 2025.

- Xbox first-party titles like DOOM: The Dark Ages won major accessibility awards at The Game Awards 2025.

- Third-party games account for 87% of Xbox Game Pass playtime per MAU.

- Game Pass live-service titles like Counter-Strike 2 earned the Best Esports Game nomination in 2025.

- Minecraft dominates as the top family-friendly franchise in the Xbox mid-2025 popularity charts.

- Xbox Game Pass hit 37 million active subscribers in Q1 2025, boosting first-party value.

- Blockbuster Xbox releases like Black Ops 6 and DOOM: The Dark Ages topped Q2 2025 sales charts.

Platform Comparison Featuring Xbox, PlayStation, and Nintendo

- PlayStation commands 45% global console market share in 2025.

- Nintendo Switch reached 154.01 million units sold by September 2025.

- Xbox holds 23% of the console market behind PlayStation and Nintendo.

- Microsoft secured 6 of the top 10 best-selling games on PlayStation in Q2 2025.

- Console subscription revenue hit $11 billion in 2025, growing faster than hardware.

- Video game subscriptions project a 14.3% annual growth rate through 2025.

- Nintendo Switch users average 6.4 hours of weekly gameplay in 2025.

- Cross-platform gamers show 31% higher return frequency than single-platform users.

In-Game Purchases and Microtransactions on Xbox

- In-game purchases generated $3.2 billion in 2024 on Xbox platforms.

- This represented a 19% year-over-year increase.

- Live-service games drive recurring microtransaction revenue.

- Social and multiplayer features boost spending behavior.

- Cross-platform access expands purchase opportunities.

- Cloud and mobile access increase transaction frequency.

- Digital content delivers higher average revenue per user.

- Bundled subscriptions encourage in-game spending.

Subscription Services and Bundle Adoption in the Xbox Space

- Xbox Game Pass generated nearly $5 billion in revenue during fiscal year 2025.

- Service reached over 35 million subscribers as of mid-2025.

- 37 million subscribers reported by Q1 2025.

- Game Pass Ultimate saw a six-fold increase in adoption over two years.

- 68% of subscribers on the Game Pass Ultimate tier in 2025.

- Cloud gaming hours from Game Pass users rose 45% year-over-year.

- Video game subscriptions are projected to grow at 14.3% annually in 2025.

- ARPU expected to increase 15.3% for Game Pass in 2025.

- Game Pass accounts for 22% of Xbox content and services revenue.

Future Outlook and Forecasts for the Xbox Brand

- Xbox cloud gaming hours from Game Pass subscribers surged 45% year-over-year.

- Global gaming market to grow by $100.8 billion from 2025 to 2029 at 8.4% CAGR.

- Cloud gaming revenues are projected to increase from $1.4 billion in 2025 to $18.3 billion by 2030.

- Xbox Game Pass reached over 35 million subscribers by mid-2025, targeting 50 million.

- Subscription-based gaming market to hit $55.94 billion by 2031 at 12.9% CAGR.

- Xbox content & services revenue up 61% in Q4 2024 amid hardware declines.

- ID@Xbox signed Game Pass deals with over 50 indie studios in 2025.

- Global gaming market forecast to reach $505.17 billion by 2030 at 8.7% CAGR.

Frequently Asked Questions (FAQs)

Xbox has reached 500 million active users worldwide in 2025.

Xbox Live had about 130 million monthly active users in 2025, up from 120 million in 2024.

Xbox Game Pass had over 37 million active subscribers in 2025.

Xbox Game Pass’ annual revenue is nearing $5 billion for the first time in 2025.

Conclusion

Xbox is no longer just a console brand; it is a multi-platform gaming ecosystem built around subscriptions, digital services, and cloud access. While hardware sales face competitive pressure, Xbox Game Pass, cloud gaming, and in-game monetization continue to drive revenue and engagement. Cross-platform play and device-agnostic access reshape how players interact with games, shifting focus from hardware ownership to service value.

Compared with PlayStation and Nintendo, Xbox emphasizes reach and flexibility over exclusivity. Looking ahead, Xbox’s strategy centers on accessibility, recurring revenue, and long-term ecosystem growth in an increasingly connected gaming industry.