Video conferencing and collaboration platforms have become central to how businesses, schools, and individuals communicate today. Among these platforms, Zoom and Microsoft Teams stand out for their broad adoption across enterprises, educational institutions, and remote work setups. Their performance, from user numbers to revenue, influences decisions about hybrid work, global meetings, and cloud collaboration. In this article, we examine up-to-date statistics that show how each platform fares, its relative strengths, and what those numbers mean for organizations and users.

Editor’s Choice

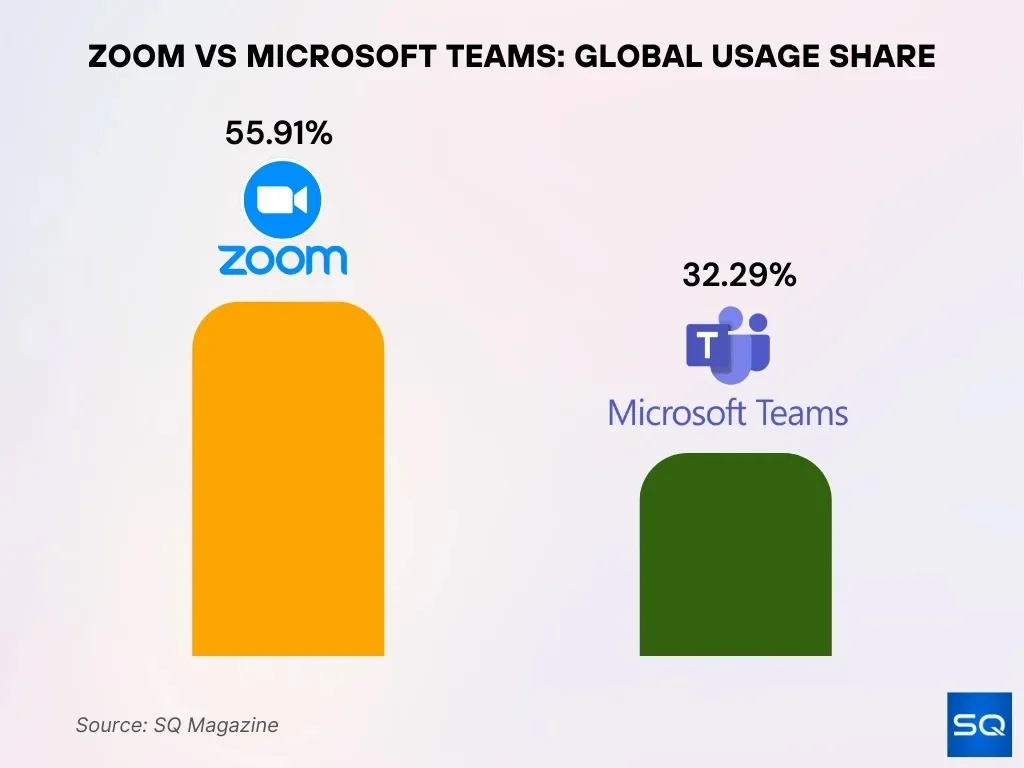

- Zoom controls about 55.9% of the global video conferencing software market in 2025.

- Microsoft Teams holds roughly 32.3% of the same market share, making it the second-largest player globally.

- Zoom reported approximately 300 million daily active users in 2025.

- Microsoft Teams reached 320 million users by 2024, reflecting sustained growth.

- Zoom generated USD 4.66 billion in revenue in fiscal 2024, underscoring robust financial performance.

- Teams counts millions of organizations in the U.S. alone as users, showing strong enterprise adoption.

- Zoom continues expanding beyond video conferencing, into AI-driven services and contact center offerings.

Recent Developments

- Zoom raised its FY2026 revenue forecast to $4.85–4.86 billion from $4.83–4.84 billion.

- Zoom Q3 revenue hit $1.23 billion, beating estimates of $1.21 billion.

- Zoom Phone surpassed 10 million paid seats globally.

- Zoom Contact Center grew to over 1,100 customers, up 100% YoY.

- Zoom has 192,600 enterprise customers with 4,274 contributing over $100,000 annually.

- AI Companion usage grew 4x year-over-year across Zoom products.

- Microsoft Teams reached 320 million monthly active users by early 2024.

- 93% of employers say collaboration tools like Zoom and Teams are essential for hybrid work.

Key User Statistics

- Zoom serves over 300 million users worldwide as of 2025.

- Zoom claims a 55.91% share of the global videoconferencing software market.

- Microsoft Teams holds roughly 32.29% market share globally.

- As of 2024, Teams reported 320 million users, marking steady growth.

- Teams serves millions of organizations, indicating strong enterprise penetration.

- Zoom counted 192,600 business customers as of Q4 2024, a decline from 220,400 in 2023.

- Zoom’s user base includes both free and paid customers, with hundreds of thousands of business users globally.

- Usage statistics show customers ranging from small businesses to large enterprises relying on Zoom for meetings, webinars, and hybrid work.

Market Share Comparison

- Zoom commands 55.91 of % global video conferencing market share in 2025.

- Microsoft Teams secures 32.29% of the video conferencing market.

- Together, Zoom and Teams dominate over 88% of the global market.

- GoToMeeting captures 8.8% market share in video conferencing.

- Webex holds 7.6% of the video conferencing market share.

- The global video conferencing market is valued at $10.62 billion in 2025.

- Zoom processes 3.3 trillion minutes of meetings annually.

- Teams generates over $8 billion in revenue from productivity tools.

- The video conferencing market is projected to reach $22.45 billion by 2033.

Revenue and Financial Performance

- Zoom reported $4.66 billion in total revenue for FY2024, up 3.1% year-over-year.

- Enterprise revenue reached $2.75 billion in FY2024, growing 5.2% YoY despite the overall slowdown.

- The company achieved $1.01 billion in net profit for FY2024, rebounding strongly post-pandemic.

- 192,600 enterprise customers reported in FY2024, with reclassifications affecting prior comparisons.

- 4,274 customers generated over $100k in annual recurring revenue as of mid-2025.

- CCaaS customers doubled to over 1,100 in Q2 FY2025, exceeding 100% YoY growth.

- 59% of Q4 FY2025 revenue came from the enterprise segment, up from prior periods.

- Revenue growth from FY2020 ($623M) to FY2024 ($4.66B) reflects a multi-year expansion trend.

- Microsoft 365 productivity segment, including Teams, generated $77 billion in FY2024.

Daily Active Users

- Zoom reports around 300 million daily active users as of 2025.

- This includes free and paid users across personal and enterprise accounts.

- Zoom’s daily participants grew from 10 million in 2019 to over 300 million by 2024.

- Teams grew from 20 million daily users in 2019 to 75 million by 2020.

- By 2023, Teams had 300 million monthly active users, rising to 320 million by 2024.

- Growth reflects increased comfort with integrated collaboration tools.

- While daily active user numbers for Teams in 2025 are limited, the large user base suggests substantial engagement.

Growth Trends

- The global video conferencing market is projected to grow at 8% CAGR between 2024 and 2030.

- About 66% of U.S. internet users engaged in video calls regularly in 2023.

- Overall, video conferencing market penetration reached roughly 66% in 2024.

- Zoom and Teams together account for over 88% of the global market.

- Teams’ integration with Microsoft 365 helps sustain long-term enterprise growth.

- Hybrid work continues to drive demand across industries.

- Video conferencing remains a cost-effective travel alternative.

- Both Zoom and Teams are evolving beyond video into full workflow platforms.

Remote Meetings vs. In-Person: What Employees Truly Believe

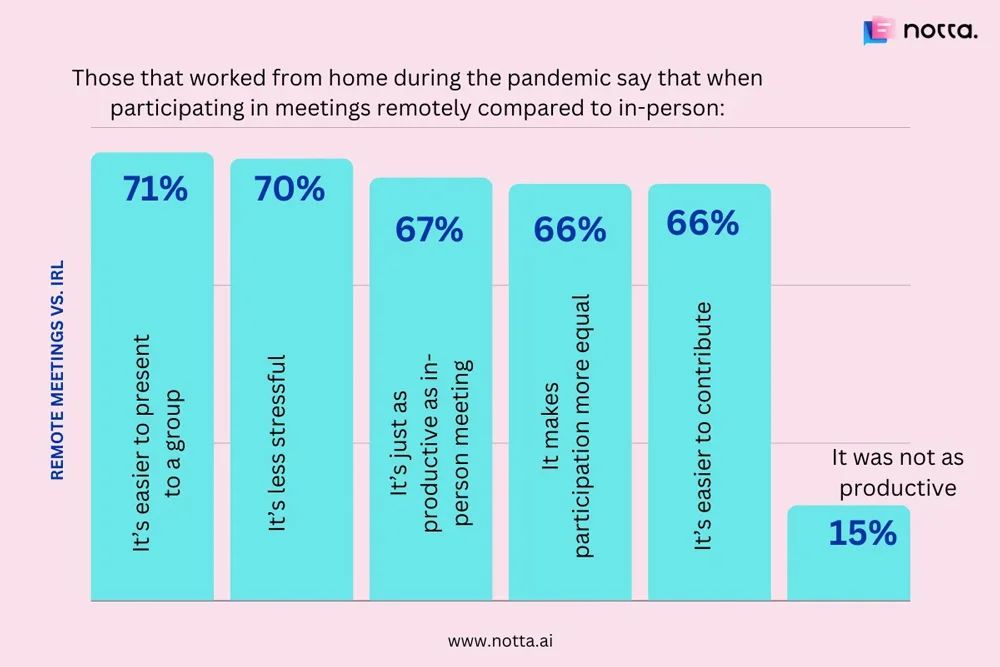

- 71% report that it is easier to present to a group when participating in remote meetings rather than in-person ones.

- 70% state that remote meetings tend to be less stressful compared to traditional in-person gatherings.

- 67% believe that remote meetings maintain productivity levels equivalent to those of in-person meetings.

- 66% feel that remote meetings help create more equal participation among everyone attending.

- 66% additionally mention that contributing during remote formats is easier than in face-to-face settings.

- Only 15% think that remote meetings were not as productive as their in-person counterparts.

App Downloads

- Zoom mobile app hit a peak of 331.32 million downloads worldwide in Q2 2020.

- In Q3 2024, the Zoom app recorded 34.92 million downloads globally across app stores.

- Zoom app downloads in France reached 423,000 during Q3 2024.

- Microsoft Teams app saw 27 million downloads worldwide in Q3 2024.

- Teams app achieved roughly 10 million downloads globally in Q3 2024 from key regions.

- Zoom app totaled 740.26 million downloads worldwide throughout 2020.

- Video conferencing apps like Zoom and Teams hit 62 million weekly downloads in March 2020.

- Zoom app saw 17.6 million downloads in Asia-Pacific during Q2 2023.

- Teams downloads in the Middle East and Africa surged to 27.4 million in Q2 2020.

Regional Adoption

- North America holds 50% of Microsoft 365 enterprise seats, fueling Teams’ dominance.

- EMEA accounts for 30% of global Microsoft 365 seats with strong Teams enterprise uptake.

- Zoom mobile app saw 15–18 million downloads in APAC Q3 2024, boosting regional adoption.

- Teams are used by 14,951 companies in the US, leading North American enterprise collaboration.

- SMBs represent 21% of Teams usage, while large enterprises hold a 32% share.

- Over 183,000 education tenants use Teams across 175 countries for class management.

- Zoom leads education with 3,293 institutional customers, preferred for external sessions.

- Asia-Pacific Zoom downloads hit 17.6 million in Q3 2024, strong in mobile-first markets.

- 93% of Fortune 100 companies deploy Teams for standardized global workflows.

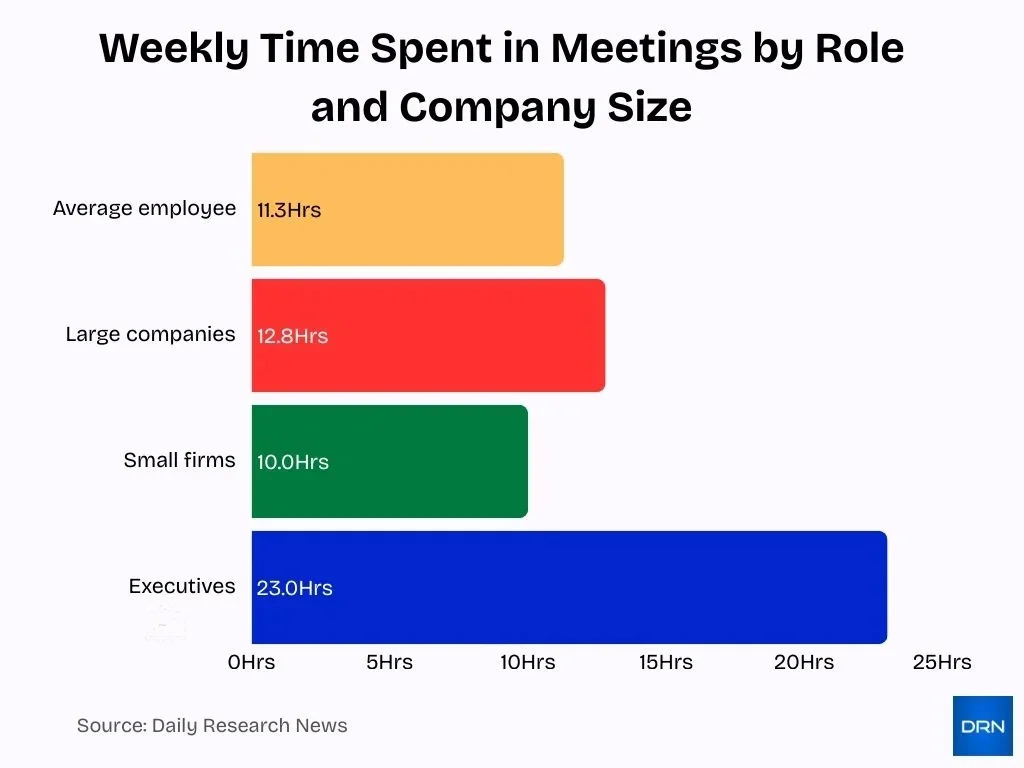

Time Spent in Meetings

- Employees spend an average of 11.3 hours per week in meetings.

- Average employee dedicates 392 hours annually to meetings, over 16 workdays.

- The number of meetings has tripled since 2020 due to hybrid work.

- 46% of professionals attend three or more meetings daily.

- 86% of meetings include at least one remote participant in hybrid settings.

- Large companies average 12.8 hours weekly in meetings versus 10 hours in small firms.

- Executives spend up to 23 hours weekly in meetings.

- Employees attend an average of 10.1 virtual meetings per week.

- Zoom hosts 300 million meetings daily, supporting distributed teams.

Video Quality Metrics

- Zoom supports HD video up to 1080p on paid plans, defaulting to 720p on lower bandwidths.

- Both Zoom and Teams provide video at 30 fps for many paid tiers.

- Zoom maintains stable video with a variable latency of about 100ms and jitter around 30ms in low-bandwidth scenarios.

- Zoom’s adaptive codec keeps video usable with packet loss up to around 45%.

- Teams supports HD video at 1080p but may downgrade to 720p dynamically if bandwidth drops below 2 Mbps.

- Teams shows smoother video performance in large meetings with gallery view up to 49 participants.

- Zoom is preferred for external calls and cross-organization meetings by approximately 60% of surveyed users.

- Teams excels in managed enterprise environments with 3 million+ premium users benefiting from consistent video quality.

- Both platforms improve compression and adaptive bandwidth, with Zoom recovering video quality within 10 seconds after network issues.

- Video quality on Zoom typically averages around a VMAF score of 80, delivering reliable clarity across conditions.

Audio Quality Metrics

- Zoom achieves top POLQA scores and lowest audio delay on stable networks, outperforming Teams and Webex.

- Team leads in echo cancellation with the highest scores in stress tests like double-talk scenarios.

- Zoom Phone retains MOS 3.3 at 70% packet loss, surpassing competitors by dynamic bitrate adjustment.

- Zoom delivers up to 56% better audio quality and 4.4x lower delay under imperfect networks.

- Both platforms use low-latency codecs like Opus, targeting under 300ms round-trip for interactive audio.

- Teams maintains stable audio in large meetings, minimizing artifacts during overlapping speech.

- Zoom preserves quality during congestion at 10 Mbps, outperforming others in ViSQOL metrics.

- Noise suppression in Zoom eliminates typing and background sounds automatically for 6x more VoIP usage.

- Multinational tests show both tools reliable, with Zoom excelling at 50%+ packet loss resilience.

AI Features

- Zoom reports 9.2% growth in customers contributing over $100,000 annually, fueled by AI adoption.

- Zoom AI Companion reached 1 million meeting summaries with 125,000+ accounts in under two months.

- Microsoft Teams boasts 320 million daily active users, boosted by AI integrations in 2024.

- 70% of Fortune 500 companies adopted Microsoft Copilot, with 82% organizational uptake.

- Teams AI tools cut administrative tasks by up to 30% in adopting organizations.

- The video conferencing market is expected to grow from $37.29 billion in 2025 to $60.17 billion by 2032.

- 78% of organizations used AI in 2024, driving collaboration platform demand.

- Zoom enterprise revenue rose 6.1% year-over-year, led by the AI Companion 3.0 launch.

Customer Segments

- 71% of professionals use Zoom for work meetings, compared to 53% for Teams.

- Over 1 million organizations worldwide use Microsoft Teams as their primary communication tool.

- Zoom serves 504,900 business customers globally, with 89% of usage for business meetings.

- 21% of Microsoft Teams users are from small businesses, favoring Zoom‘s simplicity.

- 47% of Teams users come from medium-sized businesses, while enterprises prefer its Microsoft 365 integration.

- Over 8 million U.S. companies use Teams, dominant in enterprise segments.

- Nonprofits with budgets under $10 million access Zoom at a 50% discount, boosting affordability.

- Freelancers and small teams drive Zoom‘s freemium model, converting via easy 40-minute upgrades.

- 75% of midsize businesses adopt hybrid models, using both Zoom and Teams by context.

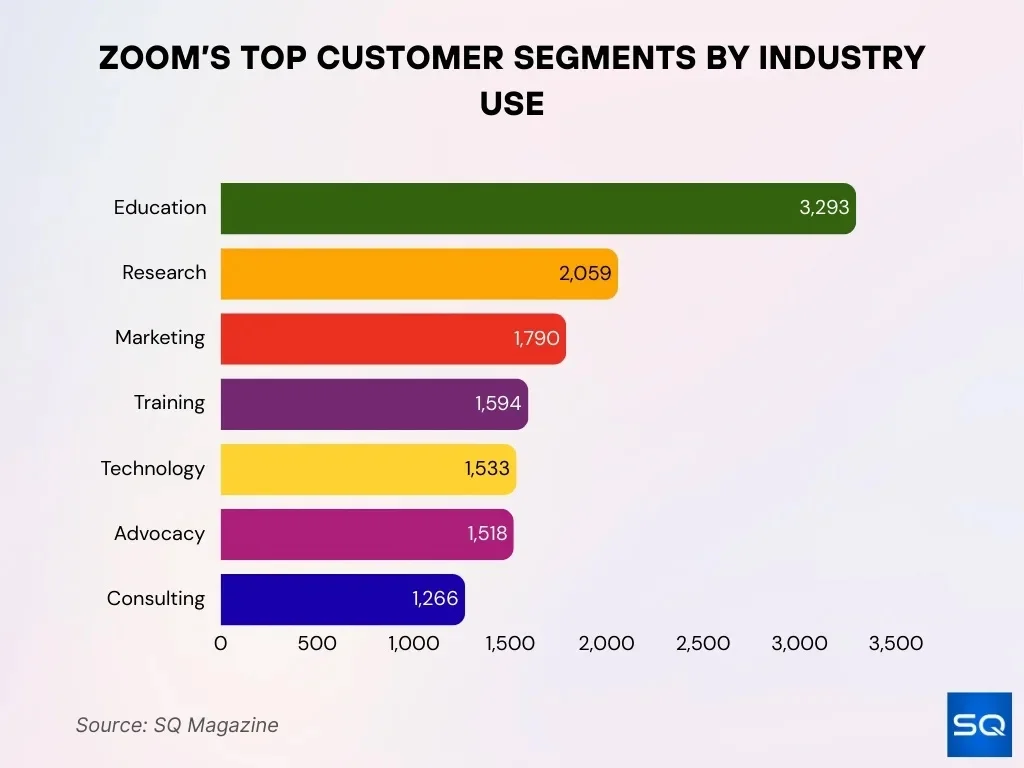

Zoom’s Leading Customer Groups by Industry Usage

- Education emerges at the forefront with 3,293 Zoom customers, establishing it as the platform’s largest user segment.

- Research organizations come next with 2,059 customers who actively leverage Zoom for collaboration purposes.

- Marketing teams represent 1,790 customers utilizing Zoom for wide-ranging campaign and outreach activities.

- Training services account for 1,594 customers, emphasizing Zoom’s essential role in skill development initiatives.

- Technology firms contribute 1,533 customers, reflecting the platform’s strong adoption within tech-driven operations.

- Advocacy groups consist of 1,518 customers who rely on Zoom for extensive outreach and mobilization efforts.

- Consulting firms complete the list with 1,266 customers using Zoom for continuous client communication.

Cloud Storage

- Microsoft Teams reached 360 million monthly active users by mid-2025, leveraging Microsoft 365 cloud storage.

- Teams, SharePoint, OneDrive, and Outlook drive over 60% of active collaboration sessions monthly.

- Cloud collaboration market to expand from $43.73 billion in 2025 to $244.71 billion by 2035 at 18.79% CAGR.

- SharePoint Online and OneDrive serve over 200 million monthly active users for file storage.

- Zoom holds 40–55% market share in video tools, favoring external storage flexibility.

- The unified communications market hits $169.90 billion in 2025, growing at a 17.4% CAGR to 2034.

- 72% of the Microsoft 365 workforce uses at least two collaboration apps weekly.

- Cloud storage market valued at $124.57 billion in 2025, reaching $273.05 billion by 2029.

Educational Adoption

- Global education video conferencing market reached $4.3 billion in 2024, projected to hit $14.7 billion by 2033 at a 14.2% CAGR.

- North America holds a 38% share of the education video conferencing market in 2024.

- Asia Pacific education video conferencing grows at the highest 17.8% CAGR through 2033.

- Over 125,000 schools in 25+ countries used Zoom for education in 2020.

- Microsoft Teams is used in 400,000+ schools/universities worldwide for learning.

- 100 million students actively use Microsoft Teams for education globally.

- 73% of teachers report that hybrid learning boosts student engagement via video tools.

- 94% of teachers support hybrid learning with video conferencing if resourced properly.

- Over 90% of countries adopted digital learning, including video conferencing, post-pandemic.

Healthcare Adoption

- The healthcare video conferencing market is expected to reach USD 12.96 billion in 2025.

- The global telehealth services market is valued at USD 71.1 billion in 2025.

- 49% of healthcare providers use Zoom for telehealth consultations.

- 13% market share for Microsoft Teams in healthcare telehealth.

- 43% of Americans will regularly use telehealth by 2025.

- Teams holds 9.6% adoption in the healthcare sector.

- The telemedicine market is projected to be USD 160.13 billion in 2025.

- 82% of patients endorse hybrid telehealth care models.

- On-premises video solutions claim 58.5% market share by 2035.

Webinar Usage

- Webinar market poised to reach $4.44 billion by 2025, tripling from 2020 levels.

- Organizations report a 46% average attendance rate for webinars across industries.

- Zoom hosted over 45 billion webinar minutes in Q3 2021 alone.

- Remote work drove a 77% increase in demand from 2019-2022.

- Nonprofits access Zoom discounts via TechSoup, starting at $75/year.

- Microsoft Teams saw a 200% surge in meetings and webinars in 2020.

- Wednesday and Thursday yield the highest webinar hosting success rates.

- 91% B2B professionals rank webinars as the top content format.

- Hybrid events fuel an 18.14% CAGR in the webinar market through 2035.

- 40-50% registrants typically attend live webinars on average.

Frequently Asked Questions (FAQs)

Zoom reports about 300 million daily active users in 2025.

Zoom holds approximately 55.91% of the global videoconferencing software market.

Microsoft Teams holds around 32.29% of the global videoconferencing market.

The global video conferencing market was valued at around USD 15.57 billion in 2024, and is projected to grow to about USD 53.98 billion by 2035 (implying a CAGR of ~11.98%).

Conclusion

Both Zoom and Microsoft Teams have carved distinct but overlapping niches in the video conferencing and collaboration landscape. Zoom remains popular among SMBs, freelancers, and organizations prioritizing ease of use and quick setup. Meanwhile, Teams draws enterprises, larger institutions, and sectors requiring integrated collaboration, compliance, and cloud storage.

Growth in education, healthcare, remote work, and webinar usage continues to fuel demand across both platforms, ensuring long-term relevance. As industries evolve, many organizations adopt a hybrid strategy, using Zoom for external and ad hoc meetings and Teams for internal collaboration and structured workflows.

Choosing between Zoom and Teams depends on an organization’s size, collaboration style, and integration needs. The data suggests there is space for both, and for many, the optimal solution is not one platform, but the right use of both.